Since Bob Herbert wrote about Reviving the Dream today, this is a good time to put up the problem-defining graphs from a longer analysis I haven't finished.

The American middle class and working class are essentially the more than 90 million non-supervisory "production workers" who constitute 84% of non-government, non-farm employment. For 26 years, from 1947 to January 1973, their average hourly pre-tax earnings, adjusted for inflation using current methods, grew robustly and steadily at an average annual "real" rate of about 2.2%. At that rate, average purchasing power would double in 33 years. Parents expected their children to have more prosperous lives than their own, and it was happening. It was the Golden Age of the Middle Class. Then, suddenly and permanently, it ended in February 1973.

The proximate cause of the sudden change is obvious. By definition, all of these "production workers" are "employed," and the BLS hourly earnings statistics are gathered from payroll records. Before 1973, employers as a group were giving their existing workforces average annual pay increases that exceeded the inflation rate by 2.2 percentage points. After 1972, they handed out increases that on average only just kept even with inflation.

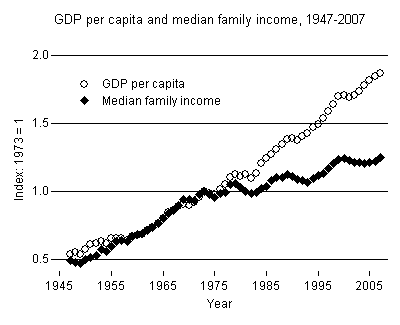

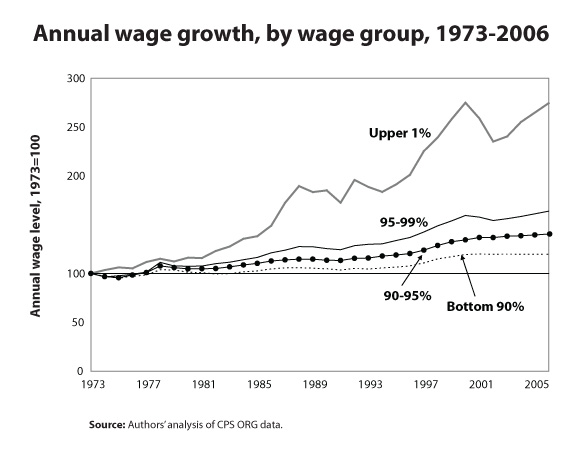

Meanwhile, the larger economy measured by real GDP per employee had a stagnant decade from 1973 to 1983. But then it took off and averaged 1.14% annual average growth for 25 years. That is modest growth compared to the 2.69% average from 1947 to 1973, but since 5/6 of American workers got a zero share of the post-1983 growth, those who did —presumably management and the owners of capital—did quite nicely.

So, here's the problem in a nutshell. Average real earnings of the 5/6 of Americans who are production workers cannot go up—and the American Dream cannot be revived—unless employers consistently grant annual wage/salary increases that on average exceed the inflation rate. What changes would motivate and enable large, trend-setting employers to return to giving average annual wage increases—for their existing workforces—that exceed inflation by 1% or 2%?

Skeptic

Skeptic