Why we are not going to recover from the Great Recession

Tuesday, September 14, 2010 at 09:30AM

Tuesday, September 14, 2010 at 09:30AM Bob Herbert's NYT column today summarizes the implications of much of my criticism about US macroeconomic policies. We can't reasonably expect to recover from the Great Recession because three-plus decades of bipartisan policies have crippled the economic ability of America's middle class to buy the goods and services that fellow Americans would like to sell. The most important point that Herbert did not make is that, although the pain of economic decline has been felt first by those with the lowest incomes and then by those in the middle, it is spreading like a cancer that will engulf many of the heretofore comfortably clueless as well.

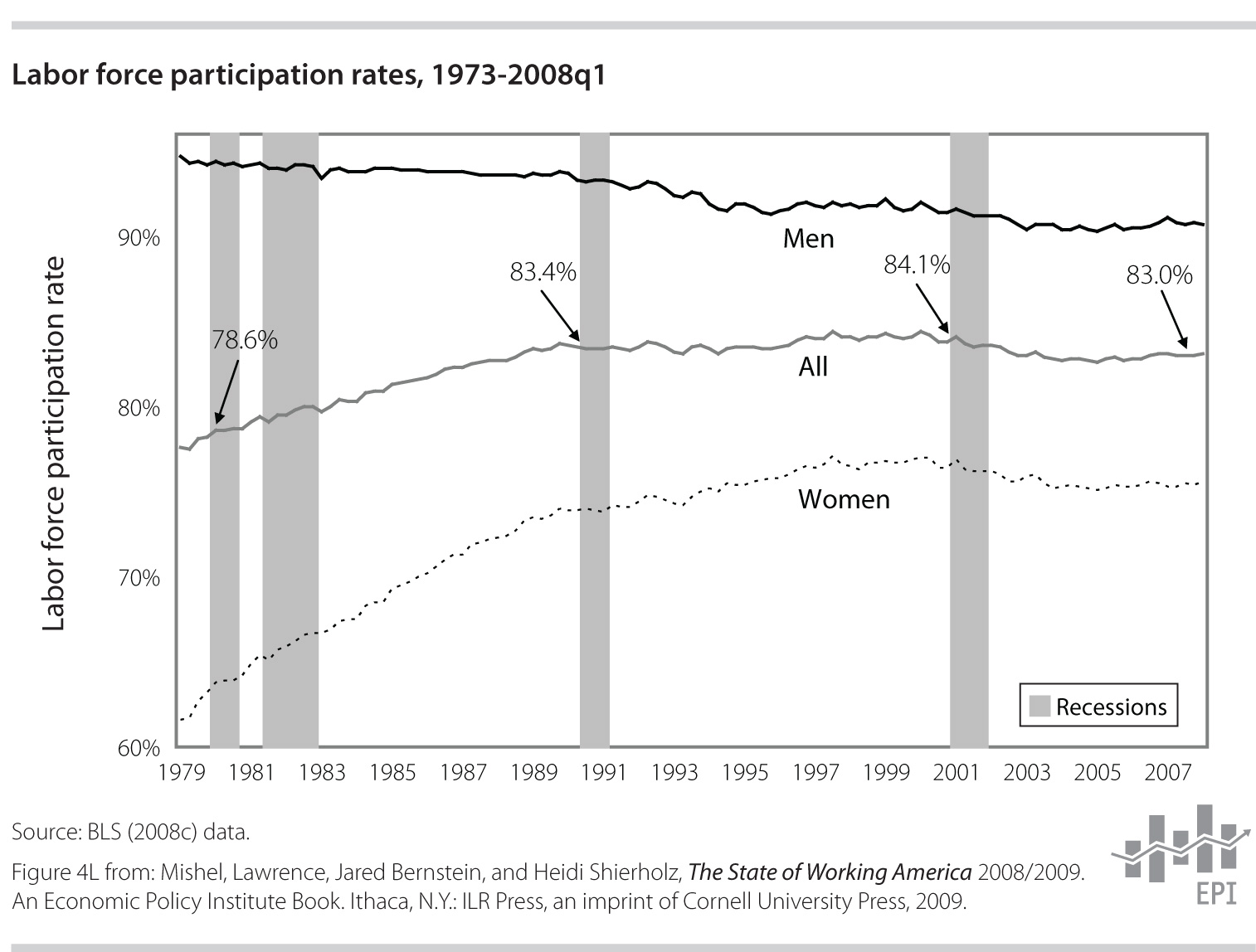

The stagnation is reflected in this graph that shows the percentage of working age adults in the workforce (either working or looking for work) has been declining since 2000.

Notice that the workforce participation rate declined right through the recent economic expansion, which occurred only because people were increasing consumption by spending borrowed money. Graphs showing stagnation of inflation-adjusted median wage rates and household incomes are collected here.

Clearly it's time to face the new reality, but too many of our leaders are clinging to current policies that will continue to shrink our national income instead of proposing new policies that will increase our national income by full employment and rising middle-class wages. We can't shrink our way to greatness, and we can't expect the outcomes to change if we don't make significant policy changes. The title to this post reflects my view that the most powerful political forces in our society will successfully defend the status quo for quite a while yet.

Skeptic

Skeptic

This graph (from Catherine Rampell on the NYT Economix blog) shows how lack of sales demand is the most important problem small businesses report.

Skeptic

Skeptic

In a 2009 survey by the Atlanta Fed, fully 55% of respondents reported deficient sales/revenues as a reason for not borrowing.